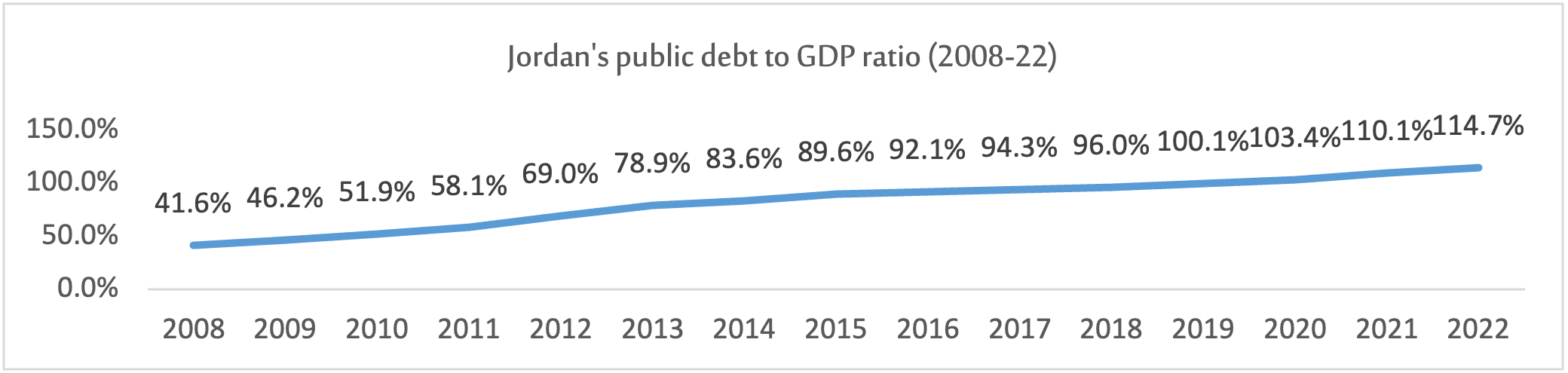

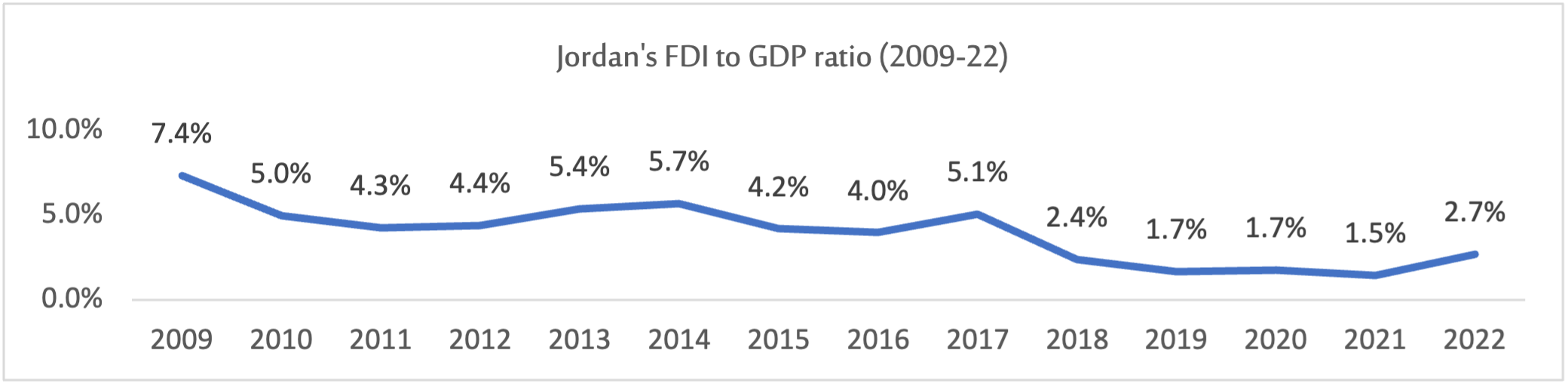

In the past few years, Jordan’s public debt has become a major policy concern for the government, the international community, and key donors that support Amman. The country’s public debt has risen significantly over the past 15 years, reaching around 114.7% of GDP by the end of 2022. This raises many questions about Jordan’s future macroeconomic stability, public debt sustainability, and the government’s ability to finance development projects. The decline in foreign direct investment (FDI) has made maintaining the sustainability of Jordan’s public debt even more challenging, with the FDI to GDP ratio falling from around 7.4% in 2009 to 2.7% in 2022. Moreover, sluggish economic growth may make it more difficult for the government to generate tax revenues from economic activities, as the International Monetary Fund forecasts economic growth rates of between 2.7% and 3% until 2027. Therefore, maintaining the sustainability of Jordan’s public debt must remain a central concern for policymakers.

External shocks and domestic demands: How did Jordan’s public debt increase?

The available data shows that both external shocks and the sluggish pace of domestic economic reforms have put tremendous pressures on Jordan’s fiscal policy. Externally, the interruption of Egyptian gas supplies to Jordan in 2011-13 led to an increase in public debt of around $7.8 billion. Moreover, the closure of the Iraqi and Syrian borders in 2013-18 put increased pressure on Jordanian exporters, and thus on government tax revenues. Domestically, the government is currently burdened by around $4.23 billion in debt due to subsidizing water.

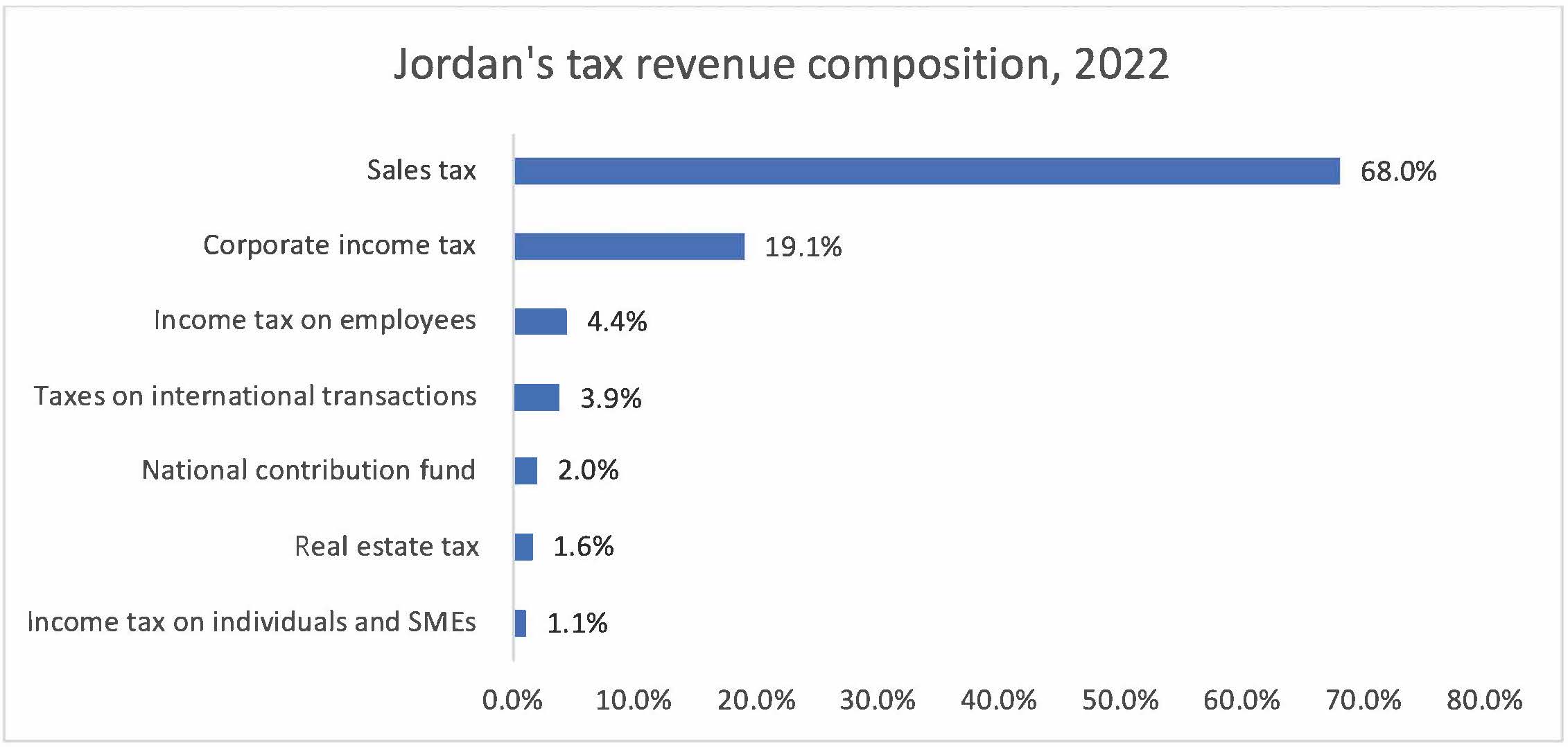

Moreover, Jordan’s historical overreliance on foreign aid to finance the general budget has led to a weak capacity on the part of the state to collect taxes and widespread tax evasion among businesses. Tax evasion is estimated to cost the state around $1.59 billion, or 12.5% of total potential tax revenues. Moreover, as a result, the government has become highly dependent on the regressive sales tax instead of generating income tax. Government revenues from sales tax accounted for around 68% of total tax revenues in 2022, while income taxes from freelance professionals and small and medium-sized enterprises (SMEs) constituted only around 1.06% of the total in the same year, as shown in the graph below.

How sustainable is Jordan’s public debt?

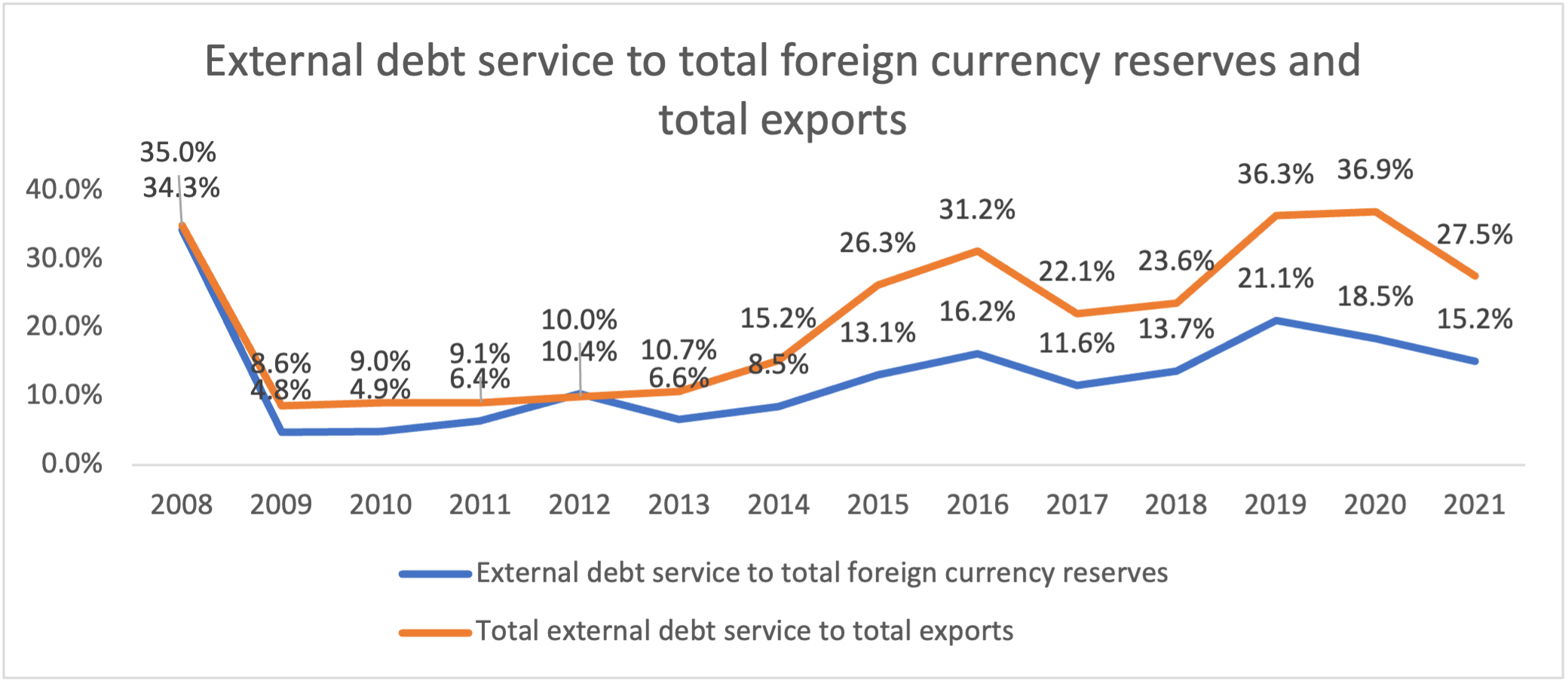

As mentioned earlier, the rise of public debt raises several questions about the sustainability of the current trajectory and the country’s overall fiscal policy. According to Ministry of Finance data, interest payments on public debt make up around 14% of overall public expenditure, rising from around 1.6% of GDP in 2008 to 4.6% of GDP by the end of 2021. Moreover, the rising levels of external debt service are putting an increasingly heavy burden on the country’s foreign currency reserves. External debt service constituted around 15.2% of Jordan’s foreign reserves balance and around 27.5% of total exports in 2021.

More importantly, the rising levels of public debt are negatively affecting the government’s fiscal ability to promote economic growth. In other words, the rising levels of public debt are leading to a shrinking of the fiscal space, reducing the government’s room for fiscal maneuvering. High levels of spending on civil servants’ wages and pensions (around 18.1% of total government expenditure) and the military (around 28.6%) further constrain the government’s finances. Thus, around 60% of Jordan’s total public expenditure goes toward security, public sector wages, and public debt interest.

However, despite this challenging fiscal situation, the government was able to increase capital expenditure to promote economic growth and meet development demands. According to Central Bank of Jordan data, capital expenditure grew around 6.7%, on average, from 2008 to 2022, while current expenditure grew only 5.2%, on average, during the same period. This indicates that the Jordanian government is succeeding in its fiscal consolidation efforts. Yet, fiscal consolidation efforts and the limited fiscal space have had a negative impact on the country’s socioeconomic development, especially in terms of health and education. For instance, Jordan scored below the regional average on the human capital index published by the World Bank in 2022. Jordanian school students also scored below the global average on the 2018 Programme for International Student Assessment (PISA) test.

Based on the above, Jordan is succeeding in maintaining the sustainability of public debt in the short and medium terms, albeit at a socio-economic cost due to its limited development spending. Moreover, Jordan might still face public debt sustainability issues in the long run if external public debt growth rates were not met with a significant rise in both exports and foreign reserves.

Economic modernization and a bet on the future

Jordanian officials acknowledge all of this and are clear-eyed about the need for urgent reforms. Within this context, Jordan adopted a new economic and administrative modernization agenda under the direct supervision of King Abdullah and Crown Prince Hussein. In a recent interview, the crown prince highlighted the importance of economic and administrative modernization in Jordan while calling for “transformation” and “making a qualitative leap in our performance.”

The modernization plan in question lays out a roadmap for major business environment reforms in the next 10 years and covers many sectors, including tourism, high-tech, agriculture, and many other industrial sectors. The plan aims to add 1 million jobs during the period 2023-33 and includes 360 investment initiatives aimed at 35 economic sectors. It also intends to accelerate digitization of the country through investments in tech infrastructure. Finally, the plan lists 13 mega-projects with investments worth around $12 billion. Proper implementation of Jordan’s modernization agenda will be a necessity to improve the foreign account balance, FDI, and government tax revenues. Therefore, addressing Jordan’s public debt problem will not only be dependent on carrying out mere fiscal reforms. It also needs to be addressed through comprehensive reforms of the business environment as outlined in the country’s modernization agenda.

Laith Alajlouni is a Jordanian political economist and social policy researcher specializing in the political economy of development in the Middle East region.

Photo by Artur Widak/NurPhoto via Getty Images

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.